What does your financial and retirement future look like?

Mai Financial Partners works to give you the support you need to reach your financial goals.

With more than 30 years financial experience, we are committed to providing our clients with the highest quality financial and retirement information, services and products to meet your goals. Our commitment to professionalism and integrity guides us in our quest to always do what is in the best interest of each client.

We want each client to understand the financial concepts behind insurance, investing, retirement income planning, estate planning and wealth preservation, as well as see the value of partnering with skilled professionals who will help you pursue your goals.

How do we do it?

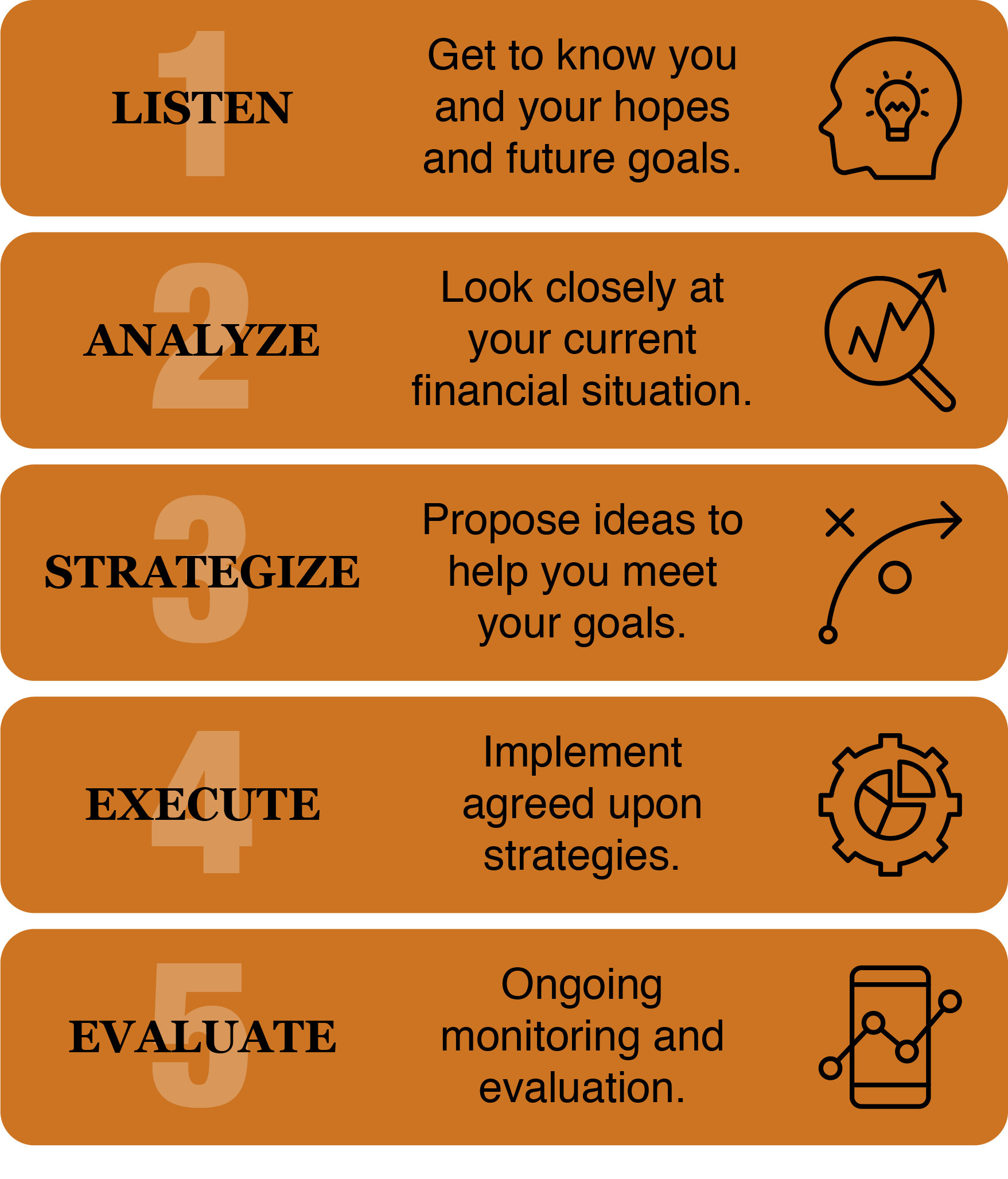

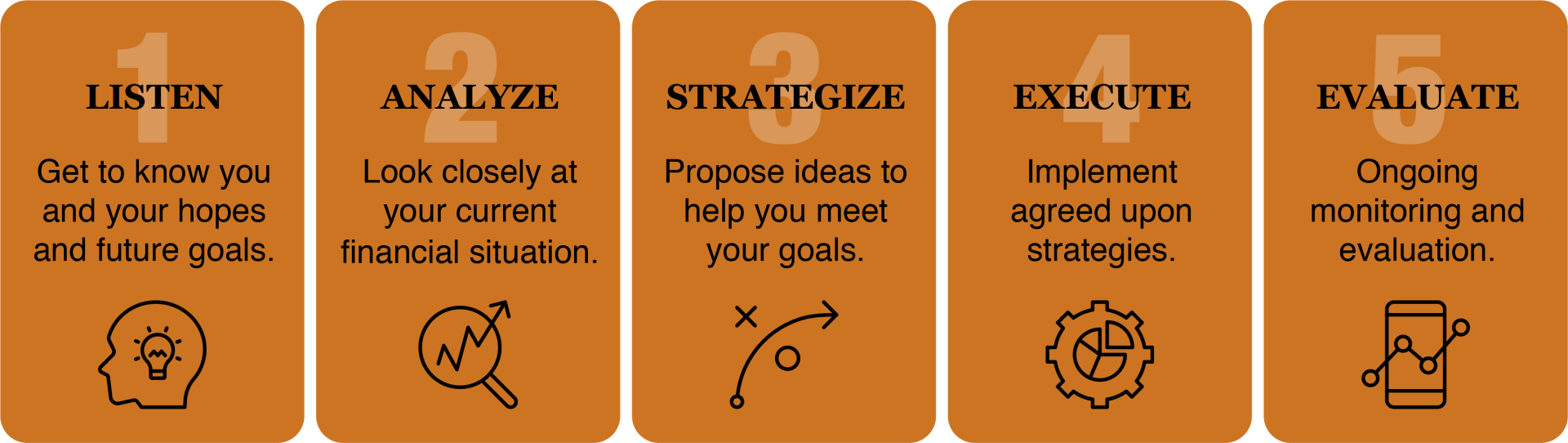

Our 5 Pillar Process is the foundation of our client success:

Ready to get started?

We look forward to meeting with you.

Comprehensive Wealth Management & Financial Planning Firm

With more than 30 years financial experience, I am committed to providing my clients with the highest quality financial and retirement information, services and products to meet your goals. My commitment to professionalism and integrity guides me in my quest to always do what is in the best interest of each client. As a financial planning firm located in Westminster, MD, I serve clients all over the Northeastern United States.

I work hard to help each client understand the financial concepts behind insurance, investing, retirement income planning, estate planning and wealth preservation, as well as see the value of partnering with skilled professionals who will help you pursue your goals. This helps us to create a strong partnership and develop a cohesive plan that takes into account all aspects of their financial lives.

How do I do it?

My 5 Pillar Process is the foundation of my client success:

Ready to get started?

I look forward to meeting with you.

Services

Services

At Mai Financial Partners, we offer a robust array of services to support your financial and retirement income planning needs, all in one place with one team of experienced professionals. Our services include:

Portfolio Management

Financial and retirement assets can be held in a variety of accounts, each with its own level of complexity and maintenance. We can help make sure all of your accounts are in sync with one another and handle the ongoing monitoring and adjustment required.

Investment Management

Aligning your portfolio allocations with your risk tolerances to help ensure that you’re comfortable with your investment choices is always the first step. After that, constant monitoring, review and assessment gives us the right information to stay the course or course-correct if needed.

Legacy

Planning

Legacy planning can be an emotional and complex series of decisions. If you want to leave your assets to heirs, a charity, or want to develop a business succession plan, we can help design a strategy to accomplish this goal.

Retirement

Income Planning

We believe an enjoyable and lasting retirement depends on having a stable retirement income. After looking at your unique financial situation, we aim to design a retirement plan that helps you create an income you won’t outlive—one that maximizes the value of your assets and preserves a legacy.

Workplace Benefits & Defined Benefit Pension Maximization

It can be difficult to know how your benefits and defined benefit pension will align with your other assets and Social Security in retirement. It’s important to review what’s in place and see if all income streams will work together to support your goals. We also help business owners with various strategies for employee benefit options.

Social Security

Maximization

Choosing when and how to draw Social Security can be a tough decision. A number of factors including marriage status, can impact your options. We can help you navigate the possibilities, so you get the most from your hard-earned benefits.

Financial & Wealth Planning

Once we know your goals, and we know the current state of your finances, we can make recommendations and create a plan for you. There are usually many paths to reaching your goal. We can help you discover the pros and cons of each to develop a comprehensive wealth management plan.

Retirement Income Planning

We believe an enjoyable and lasting retirement depends on having a stable retirement income. After looking at your unique financial situation, we aim to design a retirement plan that helps you create an income you won’t outlive—one that maximizes the value of your assets and preserves a legacy.

Insurance

People often talk about insurance as “protection,” but it’s really a form of risk mitigation. It helps to ensure that, no matter what twists and turns come with life, clients have a safety net in place. Whether it’s life, long-term care, disability, or an annuity – insurance can provide resources when most needed.

Tax Maximization

Strategies

Taxes will always be a part of life, but we can review your assets and see if strategies to reduce taxes might apply in your situation. Every dollar saved today can work for you in retirement.

Medicare

Strategies

Making Medicare sections can be complicated and impact your health care options and your health care budget for years to come. We stay up-to-date on the latest Medicare information to help clients make the best decisions for their unique situations.

Portfolio Management

Financial and retirement assets can be held in a variety of accounts, each with its own level of complexity and maintenance. We can help make sure all of your accounts are in sync with one another and handle the ongoing monitoring and adjustment required.

Investment Management

Aligning your portfolio allocations with your risk tolerances to help ensure that you’re comfortable with your wealth management choices is always the first step. After that, constant monitoring, review and assessment gives us the right information to stay the course or course-correct if needed.

Legacy Planning

Legacy planning can be an emotional and complex series of decisions. If you want to leave your assets to heirs, a charity, or want to develop a business succession plan, we can help design a strategy to accomplish this goal.

Workplace Benefits &

Pension Maximization

It can be difficult to know how your benefits and pension will align with your other assets and Social Security in retirement. It’s important to review what’s in place and see if all income streams will work together to support your goals. We also help business owners with various strategies for employee benefit options.

Social Security Maximization

Choosing when and how to draw Social Security can be a tough decision. A number of factors including marriage status, can impact your options. We can help you navigate the possibilities, so you get the most from your hard-earned benefits.

Insurance

People often talk about insurance as “protection,” but it’s really a form of risk mitigation. It ensures that, no matter what twists and turns come with life, clients have a safety net in place. Whether it’s life, long-term care, disability, or an annuity – insurance can provide resources when most needed.

Tax Strategies

Taxes will always be a part of life, but we can review your assets and see if strategies to reduce taxes might apply in your situation. Every dollar saved today can work for you in retirement.

Medicare Strategies

Making Medicare sections can be complicated and impact your health care options and your health care budget for years to come. We stay up-to-date on the latest Medicare information to help clients make the best decisions for their unique situations.

Retirement Income Planning

We believe an enjoyable and lasting retirement depends on having a stable retirement income. After looking at your unique financial situation, we aim to design a retirement plan that helps you create an income you won’t outlive—one that maximizes the value of your assets and preserves a legacy.

Portfolio Management

Financial and retirement assets can be held in a variety of accounts, each with its own level of complexity and maintenance. We can help make sure all of your accounts are in sync with one another and handle the ongoing monitoring and adjustment required.

Investment Management

Aligning your portfolio allocations with your risk tolerances to help ensure that you’re comfortable with your investment choices is always the first step. After that, constant monitoring, review and assessment gives us the right information to stay the course or course-correct if needed.

Social Security Maximization

Choosing when and how to draw Social Security can be a tough decision. A number of factors including marriage status, can impact your options. We can help you navigate the possibilities, so you get the most from your hard-earned benefits.

Workplace Benefits & Defined Benefit Pension Maximization

It can be difficult to know how your benefits and defined benefit pension will align with your other assets and Social Security in retirement. It’s important to review what’s in place and see if all income streams will work together to support your goals. We also help business owners with various strategies for employee benefit options.

Legacy Planning

Legacy planning can be an emotional and complex series of decisions. If you want to leave your assets to heirs, a charity, or want to develop a business succession plan, we can help design a strategy to accomplish this goal.

Insurance

People often talk about insurance as “protection,” but it’s really a form of risk mitigation. It helps to ensure that, no matter what twists and turns come with life, clients have a safety net in place. Whether it’s life, long-term care, disability, or an annuity – insurance can provide resources when most needed.

Tax Minimization Strategies

Taxes will always be a part of life, but we can review your assets and see if strategies to reduce taxes might apply in your situation. Every dollar saved today can work for you in retirement.

Medicare Strategies

Making Medicare sections can be complicated and impact your health care options and your health care budget for years to come. We stay up-to-date on the latest Medicare information to help clients make the best decisions for their unique situations.

Services

Services are designed with you in mind

Customized options based on your unique needs.

At Mai Financial Partners, I offer a robust array of services to support your retirement income planning needs, all in one place with an experienced professional. My services include:

Financial Planning

A comprehensive solution.

Lorem ipsum dolor sit amet, ea graeci ancillae omnesque pri, eos fugit nullam admodum in, nam omnium ancillae liberavisse an.

Business Planning

Maximizing your assets.

Lorem ipsum dolor sit amet, ea graeci ancillae omnesque pri, eos fugit nullam admodum in, nam omnium ancillae liberavisse an.

Retirement Planning

A roadmap to retirement.

Lorem ipsum dolor sit amet, ea graeci ancillae omnesque pri, eos fugit nullam admodum in, nam omnium ancillae liberavisse an.

Risk Management

Proactivity prevents reaction.

Lorem ipsum dolor sit amet, ea graeci ancillae omnesque pri, eos fugit nullam admodum in, nam omnium ancillae liberavisse an.

Long-Term Care

Maximizing your assets.

Lorem ipsum dolor sit amet, ea graeci ancillae omnesque pri, eos fugit nullam admodum in, nam omnium ancillae liberavisse an.

Insurance Strategies

A comprehensive solution.

Lorem ipsum dolor sit amet, ea graeci ancillae omnesque pri, eos fugit nullam admodum in, nam omnium ancillae liberavisse an.

Portfolio Management

Financial and retirement assets can be held in a variety of accounts, each with its own level of complexity and maintenance. I can help make sure all of your accounts are in sync with one another and handle the ongoing monitoring and adjustment required.

Investment Management

Aligning your portfolio allocations with your risk tolerances to help ensure that you’re comfortable with your investment choices is always the first step. After that, constant monitoring, review and assessment gives me the right information to stay the course or course-correct if needed.

Legacy Planning

Legacy planning can be an emotional and complex series of decisions. If you want to leave your assets to heirs, a charity, or want to develop a business succession plan, I can help design a strategy to accomplish this goal.

Workplace Benefits & Defined Benefit Pension Maximization

It can be difficult to know how your benefits and defined benefit pension will align with your other assets and Social Security in retirement. It’s important to review what’s in place and see if all income streams will work together to support your goals. I also help business owners with various strategies for employee benefit options.

Social Security Maximization

Choosing when and how to draw Social Security can be a tough decision. A number of factors including marriage status, can impact your options. I can help you navigate the possibilities, so you get the most from your hard-earned benefits.

Retirement Income Planning

I believe an enjoyable and lasting retirement depends on having a stable retirement income. After looking at your unique financial situation, I aim to design a retirement plan that helps you create an income you won’t outlive—one that maximizes the value of your assets and preserves a legacy.

Insurance

People often talk about insurance as “protection,” but it’s really a form of risk mitigation. It helps to ensure that, no matter what twists and turns come with life, clients have a safety net in place. Whether it’s life, long-term care, disability, or an annuity – insurance can provide resources when most needed.

Tax Minimization Strategies

Taxes will always be a part of life, but I can review your assets and see if strategies to reduce taxes might apply in your situation. Every dollar saved today can work for you in retirement.

Medicare Strategies

Making Medicare sections can be complicated and impact your health care options and your health care budget for years to come. I stay up-to-date on the latest Medicare information to help clients make the best decisions for their unique situations.

Financial Planning

A comprehensive solution.

Business Planning

Maximizing your assets.

Retirement Planning

A roadmap to retirement.

Risk Management

Proactivity prevents reactivity

Long-Term Care

Maximizing your assets.

Insurance Strategies

A comprehensive solution.

Meet Our Team

Dedicated to your financial future.

City skyline

City skyline

Ricky Mai

Owner & Registered Representative

For nearly three decades, Owner Ricky Mai has been living his life’s purpose to help his clients reach the retirement milestone. He gets to know each client so he can better understand what drives their goals and what will give them a sense of accomplishment and comfort once they reach the golden phase of life. Always motivated to do the right thing, caring for others, and eternally optimistic, Ricky is most happy when he works with clients and they are able to achieve a continuous income stream to fund retirement needs and wants. At Mai Financial Partners, clients are not just clients. They are considered friends and family members for life. Ricky is Series 6 and 63 registered.

In his free time, Ricky enjoys spending time with his wife Michele, daughters Heather and Amanda, sons Brady and Cody, and grandchildren, Dawson, Decker, and Quinn. He enjoys the beach and the mountains, boating, golfing, ATVing and attending Ravens football games with friends and family.

City skyline

Stacey Dillon

Office Manager

While new to Mai Financial Partners, Stacey has over 20 years of customer service experience. Stacey has quickly become part of the Mai Financial Family and strives to develop exceptional relationships with our customers. She is very personable and always willing to help. She spends most of her free time with her 8 year old son Wyatt and their dog Cherry.

Resources, knowledge and tools for you

Resources, knowledge and tools for you

Do you know your basic financial numbers?

Check out these guides and then schedule an appointment to discuss.

Download your complimentary retirement planning guide today!

Fill out the form below.

5 Essential Strategies to Help Ensure

Financial Success in Retirement

5 Steps Guide Download

We will get back to you as soon as possible.

Please try again later.

Download your complimentary Social Security guide today!

Fill out the form below.

Maximize Your Social Security Benefits

Separating Fact from Fiction

5 Steps Guide Download

We will get back to you as soon as possible.

Please try again later.

Ready to schedule

an appointment?

Contact Us

We will get back to you as soon as possible.

Please try again later.